Running an eCommerce store today means more than just having a great product or a sleek website — it also requires choosing the best payment gateways for eCommerce stores to offer customers a smooth, fast, and secure checkout experience. A reliable online payment gateway, secure payment processing system, or digital checkout solution directly impacts customer trust, conversion rates, and overall business growth. However, with so many payment gateway options available today, selecting the right one can feel overwhelming.

Many store owners worry about transaction security, hidden charges, slow settlements, or complicated integrations. These concerns are completely valid — a wrong choice can lead to abandoned carts, payment failures, and lost sales. The good news is that by understanding the right features and comparing modern eCommerce payment solutions, you can confidently choose a payment gateway that supports both customer satisfaction and long-term business success.

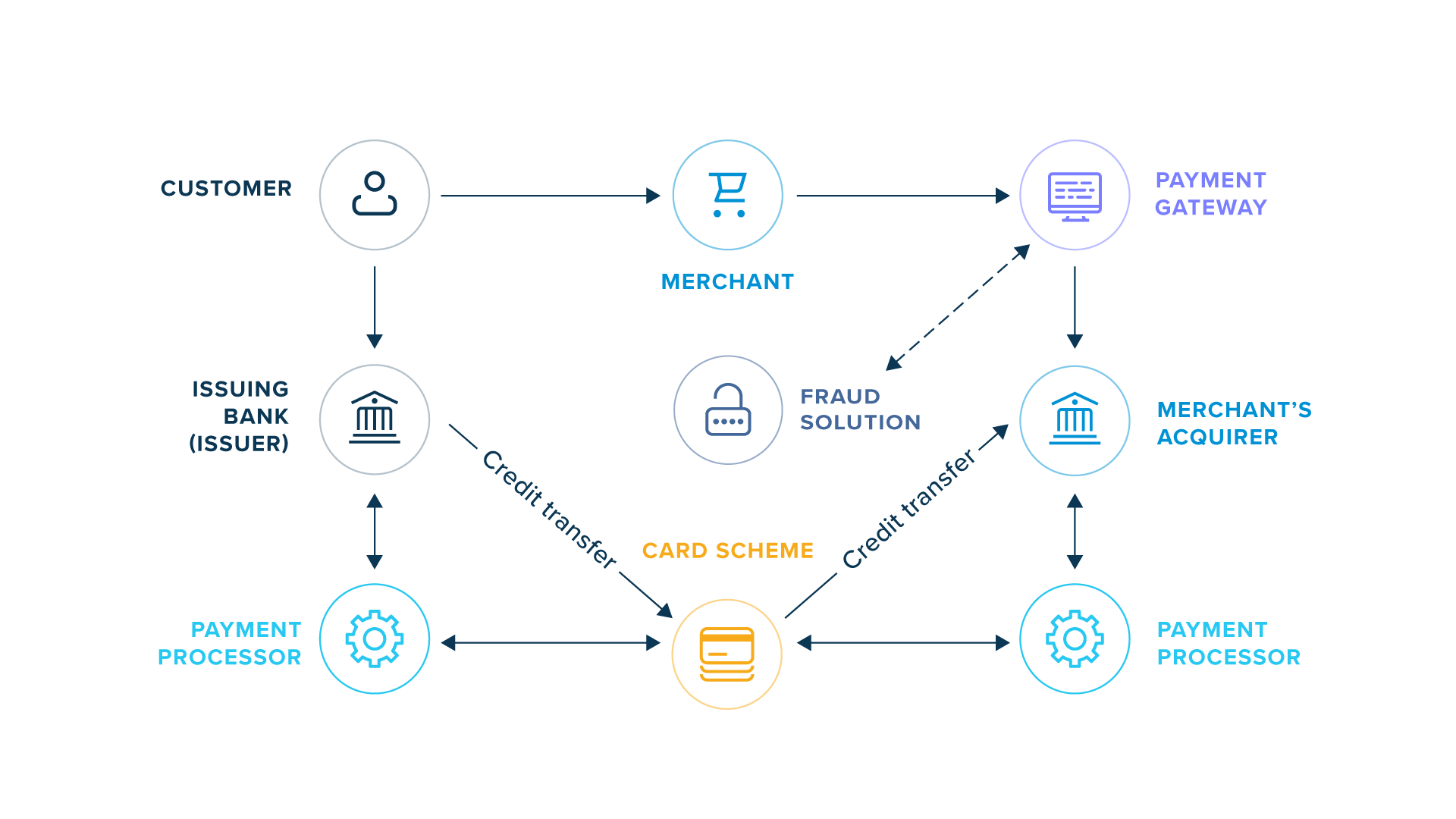

What is a Payment Gateway and Why Does It Matter?

At its core, a payment gateway is a service that processes online payments securely between customers, merchants, and banks. Think of it as the virtual cashier who ensures the money moves safely without any glitches.

Choosing the right gateway matters because it affects:

- Customer trust — Secure and smooth payments build confidence.

- Conversion rates — A frustrating checkout can lead to abandoned carts.

- Business operations — Fees, supported currencies, and integration ease impact your bottom line.

Understanding these aspects will help you prioritize what’s most important for your store.

Key Features of the Best Payment Gateways for eCommerce Stores

Security Standards Used by the Best Payment Gateways for eCommerce Stores

Before selecting a payment gateway, consider these critical features to ensure it fits your business needs:

Security and Compliance

- Look for gateways with PCI DSS compliance, which ensures they meet global security standards.

- Features like fraud detection tools and encryption protect sensitive customer information.

Payment Methods Supported

- Customers appreciate variety — the more payment options you offer (credit cards, digital wallets, bank transfers), the easier it is for them to complete purchases.

- If you have international customers, support for multiple currencies is essential.

Transaction Fees and Costs

- Understand the fee structure: some gateways charge per transaction, others have monthly fees or setup costs.

- Compare fees in relation to your average order size and sales volume to find what’s cost-effective.

Integration and User Experience

- A gateway that integrates smoothly with your eCommerce platform saves time and reduces technical headaches.

- A mobile-friendly checkout process is increasingly important as more shopping happens on smartphones.

Popular Best Payment Gateways for eCommerce Stores

PayPal – One of the Best Payment Gateways for eCommerce Stores Worldwide

To provide context, here are some widely used payment gateways with their strengths:

- PayPal: Known for ease of use and widespread recognition, PayPal offers secure transactions and supports multiple payment types.

- Stripe: Highly customizable and developer-friendly, Stripe is ideal for stores needing flexible integration and advanced features.

- Square: Great for small to medium businesses, especially those combining online and offline sales.

- Authorize.Net: A veteran in the space, offering solid fraud protection and reliability.

- Razorpay (India): Supports UPI, cards, net banking, and wallets, perfect for Indian stores.

Each gateway brings unique benefits, so matching them to your audience and technical setup is key.

How to Choose the Best Payment Gateway for eCommerce Store

Here are some simple strategies to guide your decision:

- Assess Your Customer Base: Know where your customers are and what payment methods they prefer.

- Calculate Costs Accurately: Include all fees — transaction, currency conversion, refunds — in your budgeting.

- Test User Experience: Before going live, simulate purchases on different devices to ensure smooth checkout.

- Consider Support and Resources: Reliable customer support can save time when issues arise.

By thoughtfully evaluating these factors, you set your store up for smoother operations and happier customers.

How Payment Gateways Enhance Customer Trust and Sales

Secure and seamless payment processing isn’t just about technical convenience; it builds a bridge of trust. Customers want reassurance that their data is safe and their payment will be processed without hiccups. A payment gateway that offers:

- Quick processing times

- Clear communication during checkout

- Options for recurring payments or saved cards

can significantly reduce cart abandonment rates and increase repeat purchases.

Conclusion

Selecting the best payment gateway for your eCommerce store doesn’t have to be a daunting task. By focusing on security, costs, customer preferences, and integration ease, you can find a solution that fits your unique business needs. Remember, the right payment gateway not only protects your customers but also supports your growth and builds trust.

Explore different options, test them thoughtfully, and prioritize your customers’ experience. With the right approach, your store’s checkout process will become a smooth and reassuring final step to a satisfying purchase journey.

If you’d like to learn more about optimizing your online store, consider exploring additional resources on eCommerce growth and customer experience strategies. Your journey toward a successful store is just a few smart decisions away.